All Categories

Featured

Table of Contents

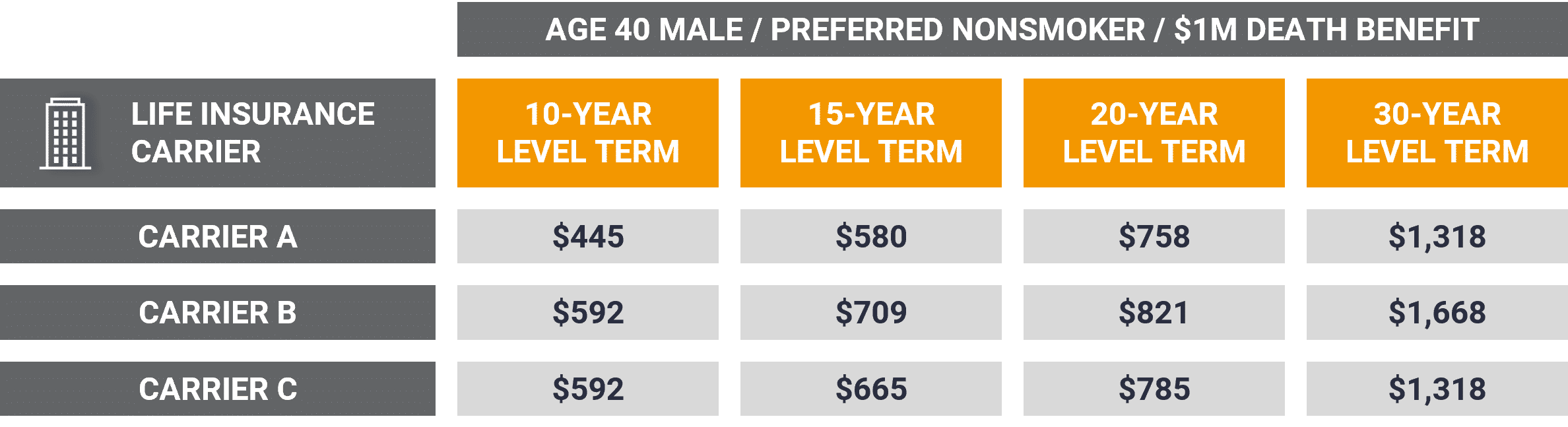

If you choose degree term life insurance policy, you can allocate your costs since they'll remain the same throughout your term. Plus, you'll understand precisely just how much of a survivor benefit your recipients will get if you pass away, as this quantity won't change either. The rates for degree term life insurance coverage will rely on several aspects, like your age, wellness status, and the insurer you pick.

When you experience the application and clinical examination, the life insurance policy business will review your application. They need to notify you of whether you have actually been approved shortly after you use. Upon approval, you can pay your initial premium and authorize any kind of relevant documents to guarantee you're covered. From there, you'll pay your premiums on a regular monthly or yearly basis.

Aflac's term life insurance is hassle-free. You can choose a 10, 20, or three decades term and enjoy the included assurance you are entitled to. Dealing with a representative can assist you locate a policy that functions finest for your requirements. Discover more and get a quote today!.

As you search for methods to secure your economic future, you've likely stumbled upon a variety of life insurance policy choices. increasing term life insurance. Picking the right coverage is a huge choice. You intend to discover something that will certainly aid support your enjoyed ones or the causes important to you if something takes place to you

Numerous people lean toward term life insurance coverage for its simplicity and cost-effectiveness. Level term insurance coverage, however, is a kind of term life insurance policy that has constant repayments and an unvarying.

High-Quality What Is Level Term Life Insurance

Level term life insurance coverage is a part of It's called "degree" since your costs and the benefit to be paid to your liked ones continue to be the very same throughout the contract. You won't see any type of changes in expense or be left questioning its worth. Some contracts, such as annually renewable term, might be structured with premiums that enhance with time as the insured ages.

Repaired death advantage. This is also set at the beginning, so you can know specifically what death advantage amount your can anticipate when you pass away, as long as you're covered and current on premiums.

You agree to a fixed costs and fatality advantage for the duration of the term. If you pass away while covered, your fatality advantage will certainly be paid out to enjoyed ones (as long as your premiums are up to date).

You might have the option to for an additional term or, more probable, restore it year to year. If your contract has actually an assured renewability condition, you may not need to have a brand-new medical examination to maintain your protection going. Nevertheless, your costs are likely to boost since they'll be based on your age at revival time (level term life insurance definition).

With this option, you can that will last the rest of your life. In this situation, again, you might not need to have any kind of brand-new medical exams, however premiums likely will increase as a result of your age and brand-new protection. term vs universal life insurance. Different business provide different options for conversion, make certain to understand your choices before taking this action

Term Life Insurance For Couples

Speaking with a financial expert likewise might assist you identify the course that straightens finest with your general method. The majority of term life insurance policy is level term throughout of the agreement duration, yet not all. Some term insurance policy may come with a premium that increases with time. With reducing term life insurance coverage, your survivor benefit decreases in time (this kind is typically gotten to particularly cover a long-lasting financial debt you're repaying).

And if you're established for sustainable term life, after that your premium likely will go up annually. If you're discovering term life insurance and intend to ensure uncomplicated and foreseeable economic security for your family members, degree term might be something to think about. As with any kind of kind of protection, it might have some restrictions that do not meet your needs.

Family Protection Which Of These Is Not An Advantage Of Term Life Insurance

Commonly, term life insurance policy is extra inexpensive than permanent protection, so it's a cost-effective method to secure economic defense. At the end of your contract's term, you have multiple options to continue or move on from protection, typically without needing a clinical test.

:max_bytes(150000):strip_icc()/Investopedia-terms-termlife-6451fde927474d4f8a81a5681efd393f.jpg)

As with other kinds of term life insurance, when the contract ends, you'll likely pay greater costs for coverage because it will certainly recalculate at your current age and health and wellness. If your economic scenario adjustments, you may not have the necessary protection and may have to purchase added insurance policy.

However that does not mean it's a suitable for everybody. As you're buying life insurance coverage, below are a few key factors to think about: Budget. Among the advantages of degree term coverage is you know the cost and the death benefit upfront, making it much easier to without stressing over rises over time.

Age and health and wellness. Usually, with life insurance coverage, the healthier and more youthful you are, the a lot more budget friendly the coverage. If you're young and healthy and balanced, it might be an appealing option to lock in reduced premiums now. Financial responsibility. Your dependents and financial obligation play a duty in establishing your coverage. If you have a young family, as an example, degree term can aid offer economic support throughout critical years without paying for protection longer than required.

1 All riders are subject to the terms and conditions of the rider. Some states may vary the terms and conditions.

2 A conversion credit history is not available for TermOne plans. 3 See Term Conversions section of the Term Collection 160 Product Guide for how the term conversion credit scores is determined. A conversion credit rating is not readily available if costs or charges for the brand-new plan will be forgoed under the terms of a motorcyclist supplying handicap waiver benefits.

Exceptional A Renewable Term Life Insurance Policy Can Be Renewed

Policies converted within the very first policy year will certainly receive a prorated conversion credit score based on terms of the policy. 4 After 5 years, we book the right to limit the irreversible item provided. Term Series products are released by Equitable Financial Life Insurance Firm (Equitable Financial) (NY, NY) and are co-distributed by Equitable Network, LLC (Equitable Network Insurance Company of The Golden State, LLC in CA; Equitable Network Insurance Coverage Firm of Utah in UT; and Equitable Network of Puerto Rico, Inc. Term Life Insurance Policy is a kind of life insurance coverage policy that covers the policyholder for a details quantity of time, which is called the term. The term lengths differ according to what the individual selects. Terms commonly vary from 10 to 30 years and rise in 5-year increments, offering level term insurance.

Latest Posts

The Best Funeral Insurance

Final Expense Companies

Life Insurance For Funeral Expenses