All Categories

Featured

Table of Contents

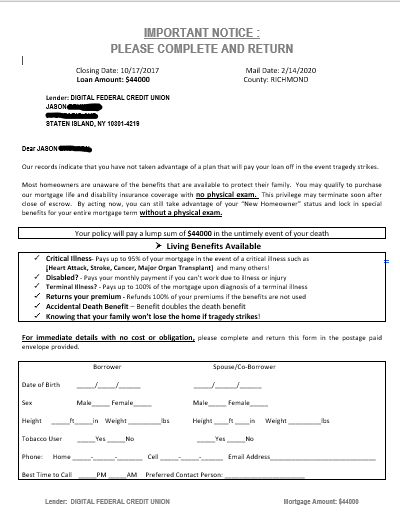

Home loan life insurance provides near-universal protection with marginal underwriting. There is typically no medical checkup or blood example called for and can be a useful insurance coverage alternative for any property owner with serious pre-existing medical conditions which, would certainly stop them from buying conventional life insurance policy. Various other advantages include: With a home mortgage life insurance plan in position, successors won't have to worry or wonder what could happen to the family members home.

With the mortgage repaid, the family will always belong to live, offered they can afford the real estate tax and insurance policy each year. allstate mortgage disability insurance.

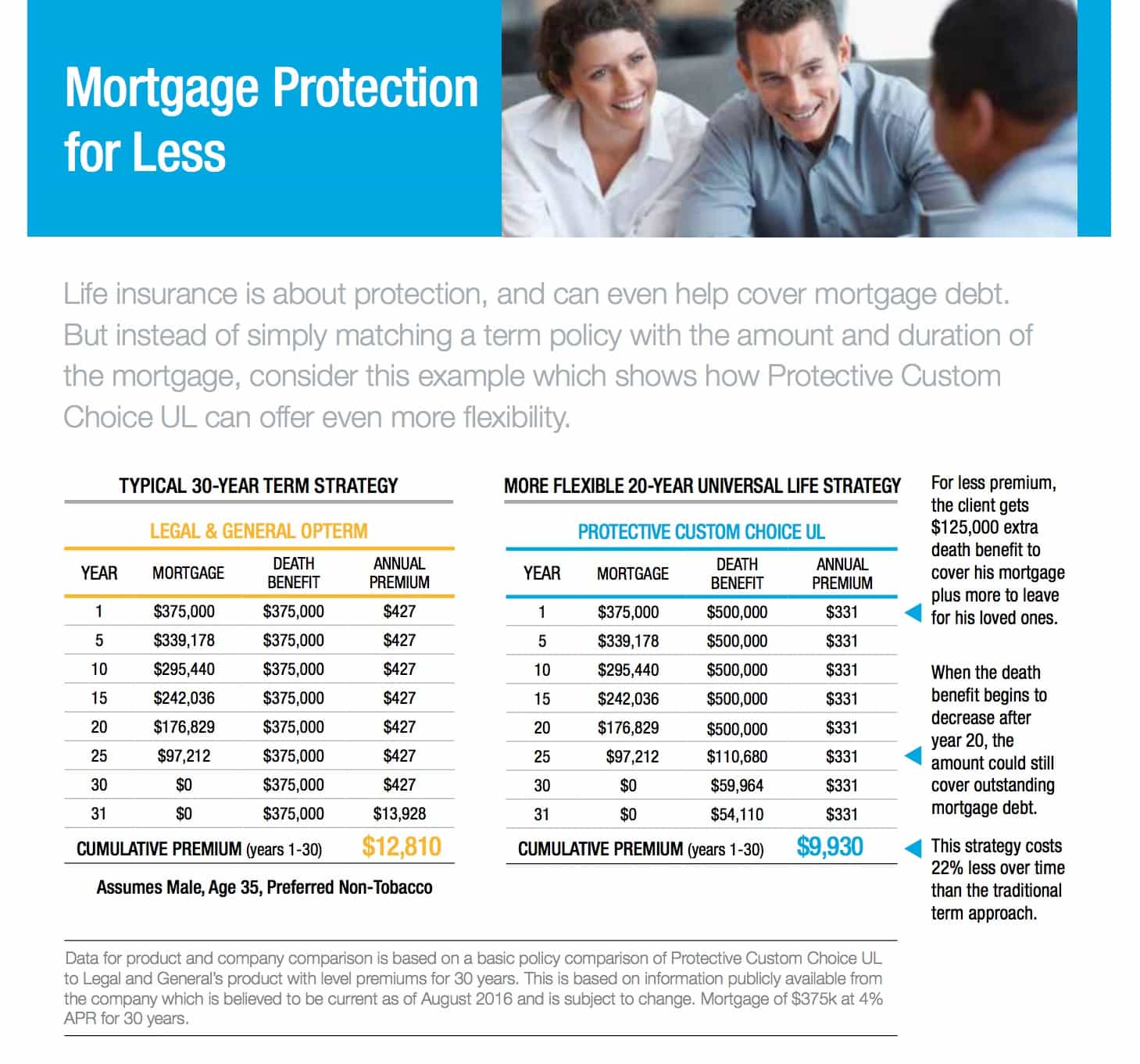

There are a couple of various types of home loan defense insurance, these include:: as you pay more off your mortgage, the quantity that the plan covers reduces in line with the impressive equilibrium of your mortgage. It is the most typical and the cheapest type of home mortgage protection - what is mortgage insurance payment.: the quantity guaranteed and the premium you pay remains level

This will repay the home mortgage and any type of staying equilibrium will go to your estate.: if you desire to, you can add major illness cover to your home mortgage security policy. This indicates your home loan will be gotten rid of not only if you pass away, but likewise if you are detected with a major disease that is covered by your plan.

Mortgage Insurance After Death

In addition, if there is an equilibrium staying after the mortgage is removed, this will certainly go to your estate. If you change your mortgage, there are numerous things to think about, depending upon whether you are covering up or expanding your home loan, changing, or paying the home mortgage off early. If you are covering up your home loan, you need to see to it that your policy fulfills the brand-new worth of your mortgage.

Contrast the costs and benefits of both choices (how does mortgage insurance work). It might be less expensive to keep your original home mortgage security policy and after that get a 2nd plan for the top-up amount. Whether you are covering up your home loan or extending the term and need to get a brand-new plan, you may find that your costs is higher than the last time you got cover

Federal Mortgage Protection

When switching your home loan, you can appoint your mortgage protection to the brand-new loan provider. The costs and degree of cover will coincide as prior to if the amount you borrow, and the regard to your mortgage does not change. If you have a plan via your loan provider's group plan, your lending institution will certainly terminate the plan when you change your home loan.

In The golden state, mortgage defense insurance policy covers the entire outstanding equilibrium of your funding. The fatality benefit is a quantity equal to the equilibrium of your home mortgage at the time of your passing.

Mortgage Insurance Application

It's important to comprehend that the survivor benefit is given directly to your creditor, not your enjoyed ones. This guarantees that the staying financial obligation is paid completely which your enjoyed ones are spared the monetary stress. Mortgage defense insurance policy can likewise provide momentary protection if you become handicapped for a prolonged duration (typically six months to a year).

There are several benefits to getting a home loan protection insurance plan in California. A few of the leading advantages include: Assured approval: Even if you remain in inadequate wellness or operate in a dangerous occupation, there is assured authorization without medical examinations or lab examinations. The exact same isn't true for life insurance.

Special needs security: As mentioned above, some MPI plans make a few home mortgage repayments if you become disabled and can not generate the very same income you were accustomed to. It is essential to note that MPI, PMI, and MIP are all different types of insurance policy. Home mortgage protection insurance (MPI) is developed to settle a home loan in situation of your fatality.

Is Homeowners Insurance Same As Mortgage Insurance

You can even apply online in mins and have your plan in location within the very same day. To learn more about obtaining MPI insurance coverage for your home mortgage, get in touch with Pronto Insurance today! Our knowledgeable agents are here to respond to any type of concerns you may have and give further help.

It is recommended to contrast quotes from various insurance providers to discover the very best price and protection for your demands. MPI provides a number of benefits, such as peace of mind and simplified credentials processes. Nonetheless, it has some restrictions. The death advantage is straight paid to the lending institution, which restricts versatility. Furthermore, the advantage quantity decreases gradually, and MPI can be extra costly than basic term life insurance policy policies.

Life Insurance To Cover Mortgage Only

Enter fundamental information concerning yourself and your mortgage, and we'll compare rates from various insurance companies. We'll additionally show you just how much insurance coverage you need to protect your mortgage. Get begun today and provide yourself and your family the tranquility of mind that comes with recognizing you're protected. At The Annuity Specialist, we understand property owners' core trouble: guaranteeing their family can preserve their home in the event of their fatality.

The primary benefit here is clearness and self-confidence in your choice, recognizing you have a plan that fits your needs. As soon as you accept the plan, we'll manage all the paperwork and setup, ensuring a smooth implementation process. The favorable result is the comfort that includes knowing your family members is safeguarded and your home is secure, no matter what occurs.

Specialist Recommendations: Assistance from knowledgeable specialists in insurance policy and annuities. Hassle-Free Arrangement: We deal with all the documents and implementation. Affordable Solutions: Finding the most effective protection at the most affordable possible cost.: MPI specifically covers your mortgage, giving an added layer of protection.: We function to locate the most cost-effective solutions tailored to your spending plan.

They can give details on the insurance coverage and benefits that you have. Usually, a healthy and balanced person can expect to pay around $50 to $100 each month for mortgage life insurance. It's suggested to acquire an individualized home loan life insurance policy quote to obtain a precise quote based on private situations.

Latest Posts

The Best Funeral Insurance

Final Expense Companies

Life Insurance For Funeral Expenses