All Categories

Featured

It enables you to spending plan and strategy for the future. You can conveniently factor your life insurance into your spending plan since the costs never transform. You can prepare for the future equally as easily due to the fact that you understand specifically how much money your liked ones will obtain in the occasion of your lack.

This holds true for people who quit smoking cigarettes or who have a health and wellness condition that fixes. In these situations, you'll normally have to go through a brand-new application procedure to obtain a better rate. If you still require insurance coverage by the time your degree term life policy nears the expiry day, you have a few options.

Many degree term life insurance policy plans include the alternative to restore protection on an annual basis after the preliminary term ends. level term life insurance. The expense of your policy will certainly be based upon your present age and it'll boost annually. This could be a great choice if you only require to prolong your insurance coverage for one or 2 years or else, it can get pricey pretty rapidly

Degree term life insurance is just one of the most affordable coverage options on the market because it offers fundamental security in the type of survivor benefit and only lasts for a set time period. At the end of the term, it ends. Whole life insurance policy, on the various other hand, is considerably extra expensive than level term life due to the fact that it doesn't expire and comes with a cash money worth function.

Reputable Group Term Life Insurance Tax

Rates might vary by insurance firm, term, protection amount, wellness course, and state. Level term is an excellent life insurance choice for most people, yet depending on your coverage requirements and personal scenario, it may not be the finest fit for you.

Yearly eco-friendly term life insurance policy has a term of only one year and can be renewed annually. Annual renewable term life costs are at first less than level term life costs, yet costs increase each time you renew. This can be a good alternative if you, for instance, have just stop smoking and require to wait two or 3 years to obtain a level term plan and be eligible for a lower rate.

Renowned Short Term Life Insurance

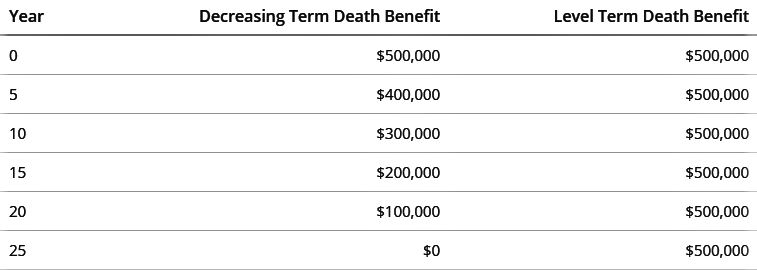

, your death benefit payment will certainly lower over time, yet your payments will remain the exact same. On the various other hand, you'll pay more ahead of time for less coverage with a raising term life policy than with a degree term life plan. If you're not certain which type of policy is best for you, functioning with an independent broker can help.

As soon as you have actually chosen that degree term is appropriate for you, the following action is to buy your policy. Right here's how to do it. Compute how much life insurance you require Your protection amount ought to offer your family's lasting economic demands, including the loss of your earnings in case of your fatality, in addition to financial obligations and everyday expenses.

A level premium term life insurance policy plan lets you stick to your spending plan while you aid protect your household. ___ Aon Insurance Services is the brand name for the broker agent and program administration procedures of Fondness Insurance Solutions, Inc. (TX 13695) (AR 100106022); in CA & MN, AIS Fondness Insurance Company, Inc. (CA 0795465); in Okay, AIS Fondness Insurance Coverage Services Inc.; in CA, Aon Affinity Insurance Services, Inc.

The Plan Agent of the AICPA Insurance Coverage Depend On, Aon Insurance Coverage Services, is not affiliated with Prudential.

Latest Posts

The Best Funeral Insurance

Final Expense Companies

Life Insurance For Funeral Expenses